Tigon Consultancy provides Expat Life & Health insurance in Bangkok, Thailand at reasonable rates.

Expat Health Insurance

- Free Consultation

- World Wide Cover – In-Patient or with Out-Patient cover.

- Individual, Family and Company Group plans.

- Health Insurance plans for over 65’s.

- Click here for Medical Insurance.

Expat Life Insurance

- Whole of Life or Term Life policies options.

- Tailored around you and your requirements.

- Monthly or Annual premium options.

- Free Consultation.

- Click here for Life Insurance

Other Insurances

- International Travel Insurance.

- Home and Contents Insurance.

- 3rd Party Insurance

- Personal Accident Insurance.

- Free Consultation

- Click here for Travel Insurance

Do not let your low budget put you off getting Health Insurance !

For an Expat, having an affordable and good health insurance policy is as ever important as the apartment that you live in, and food that you eat.

For an Expat, having an affordable and good health insurance policy is as ever important as the apartment that you live in, and food that you eat.

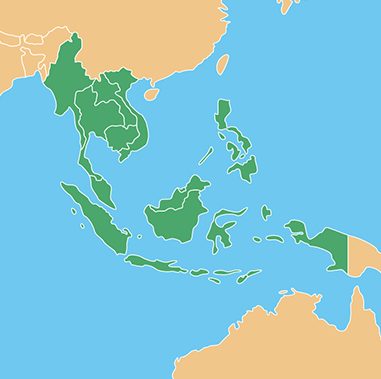

Choosing a local healthcare plan or one from an international medical Insurance company, as an Expatriate, will make a big difference to your stay in your new host country, be it Thailand, Laos, Vietnam or Cambodia.

You can choose from a very basic local health insurance plan to a more comprehensive International Medical Insurance plan. Your age and budget will determine this.

Getting medical treatment at a well equipped and decent hospital with trained personal is very important and having a good Health Insurance policy allows you to choose the hospital, when you need it most.

Most Insurance companies have a large network of approved hospitals to help you, and with direct billing facilities.

Our partnering Medical Insurance Companies provide a wide range of healthcare plans that you can choose from, suiting all budget types, designed for Expats, foreigners and local Thailand nationals, living, travelling or working abroad. These plans can be tailored around you and your needs, by our trained personal.

No obligation, health insurance proposals are provided for your consideration.

A Health Guide for Men – Understanding and Preventing Hemorrhoids:

A Health Guide for Men to Understanding and Preventing Hemorrhoids:

Hemorrhoids, also known as piles, are a common yet often uncomfortable condition that affects many men worldwide. Despite the stigma and discomfort associated with discussing this issue, it is crucial to understand what hemorrhoids are, how to recognize their symptoms, and how to prevent and treat them effectively. This article is designed to provide men with a comprehensive understanding of hemorrhoids and give practical advice on prevention and treatment.

What Are Hemorrhoids?

Hemorrhoids refer to swollen blood vessels in the lower part of the rectum and anus, collectively called the anorectum. These veins can become engorged, causing pain, irritation, and sometimes bleeding, especially during bowel movements. The anorectum is highly vascular, meaning it is rich in blood vessels that are susceptible to swelling. This can occur due to a variety of factors like excessive straining, poor diet, and lifestyle choices.

While hemorrhoids can affect anyone, they tend to be more common as men age. Other contributing factors include obesity, chronic constipation, and sitting for extended periods, which is something men who work long office hours may experience. The good news is, hemorrhoids can be easily managed and even prevented with the right lifestyle changes and treatment options.

Key Symptoms of Hemorrhoids Men Should Look For

Is Health Insurance that expensive?

Worried about the Costs of Health Insurance while you live in Thailand?

It depends on which angle you are looking at from.

Has the Modern Man Become Too Dependent on Pills?

As we navigate the ever-changing landscape of modern health, it’s hard to miss the growing trend of relying on pills for almost every ailment. Over the years, the occasional necessity of taking medication has turned into a regular habit for many people. Advertisements for supplements and quick fixes are everywhere, offering seemingly effortless solutions to complex problems. But beneath the convenience, we have to ask: have we become too dependent on these pharmaceutical solutions?